Tax returns

14 Apr 2004CBPP has an awesome summary of the effects of the Bush administration tax cuts up:

*</p>

The early returns on the effects of the tax cuts have not been good.

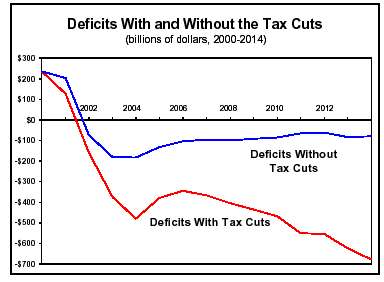

- The Bush tax cuts have contributed to revenues dropping in 2004 to the lowest level as a share of the economy since 1950, and have been a major contributor to the dramatic shift from large projected budget surpluses to projected deficits as far as the eye can see.

- The tax cuts have conferred the most benefits, by far, on the highest-income households – those least in need of additional resources – at a time when income already is exceptionally concentrated at the top of the income spectrum.

- The design of these tax cuts was ill-conceived, resulting in significantly less economic stimulus than could have been accomplished for the same budgetary cost. In part because the tax cuts were not as effective as alternative measures would have been, job creation during this recovery has been notably worse than in any other recovery since the end of World War II.

</i>

The paper then goes into detail on each round of tax cuts, with lots of pretty graphs. Pretty depressing, that is. Like this one:

Well those first two parts, at least, were the POINT of the tax cut. Good Republicans will tell you that they want government revenues to be a very small fraction of GNP, a fraction that gets smaller every year. And Bush wanted to play to his base.