tax man

15 Aug 2004Bill Hobbs quotes Jeff Cornwall on the CBO report, possibly quoting this NRO piece? Or was he the original author, maybe?

Anyways, the post says:

While many characterize the CBO report as evidence that the tax cuts shifted the burden of taxation to the middle class, CBO data show precisely the opposite effect. The tax cuts actually made the tax system more progressive. The highest 20 percent of earners now pay a larger share of federal income taxes than they would have without the tax cuts, while the share of income taxes paid by all other income groups fell.

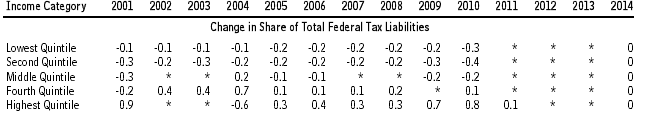

No. This is an incorrect conclusion based on a highly misleading assumption. As I have previously noted, simply choosing to ignore payroll taxes entirely doesn’t mean they don’t exist. Here is the relevant table for share of federal tax liability in general:

Under 2004, you can see what the media is talking about when they say the tax burdern was “shifted” to the middle class. The highest quintile took a -0.6 percent dip, while the 3rd and 4th quintiles went up 0.9 percent.

Mr. Cornwall, on the other hand, is looking at income tax alone. So, the CBO report doesn’t show “precisely the opposite” of a shift in the burden of taxation to the middle class. It shows something different if you ignore half of the tax structure that affects the lower quintiles the most. And believe me, you’d have to do a lot of ignoring to convince yourself that this report concludes that the tax structure is “more progressive”.

Further, as Brad DeLong notes, regardless of who the tax cuts favor, we need to be focusing as well on the “elephant in the living room”:

… that the deficits produced by these tax cuts are raising the national debt, that the national debt has to be serviced (unless we want to see the economy collapse into hyperinflation), and that the burden of servicing the national debt will raise taxes in the future. What we are talking about is not a tax cut, but a tax shift–a shift in taxes from today’s upper class to tomorrow’s middle class.

The SSI portion is progressive on the return. It takes only a small investment to get the maximum benefit. It is a total rip-off to everyone who participates though. 15% of your income every year for 45+ years for a $1000 per month life annuity that evaporates upon death? Even someone working for minimum wage and investing conservatively would accumulate a nest-egg of over 1/2 million dollars which would provide much more interest income that $1000 per month plus it would be an asset that could be passed on to one’s family upon death. Those who contribute the max (around $85K now I think) really get screwed. They could have accumulated more than $5M but are saddled with the same paltry $1000 per month return.

Reagan attempted to roll SSI in under the progressive tax structure in his tax reform plan but, for appearances, this was blocked by House and Senate Democrats in ignorant demagoguery against the Whitehouse.